Banks serve as an important enabler in the operations of the ASEAN Customs Transit System (ACTS), therefore the seventh ACTS Outreach Event was specifically organized to engage with banks in the ASEAN region. The event garnered great interest within a community of practice involving 51 banks and 115 participants from Cambodia, Laos, Malaysia, Singapore, Thailand, and Vietnam joining the virtual event held in February 2023.

The event begin with keynote speeches from banks that have already taken an active role in ACTS movements in the region. The keynote speeches were delivered by; Mr Ahmad Hijazi Bin Mohtar, Head of Trade Finance Solutions, Group Transaction Banking of RHB Bank Berhad, Malaysia, Ms Khun Tulaya Kaskumthorn, Vice President, FI Trade Sales & Trade Solutions of Krungthai Bank, Thailand, Mr Ruben Charles, the Manager of Trade Processing Center of CIMB Bank Berhad, Malaysia, Mr Nguyen Ngoc Quang, Deputy Director of Financial Institutions Group of Vietcom Bank, Vietnam and Ms Le Thuy Duong, Deputy Director of Trade Finance Center of Vietcom Bank, Vietnam.

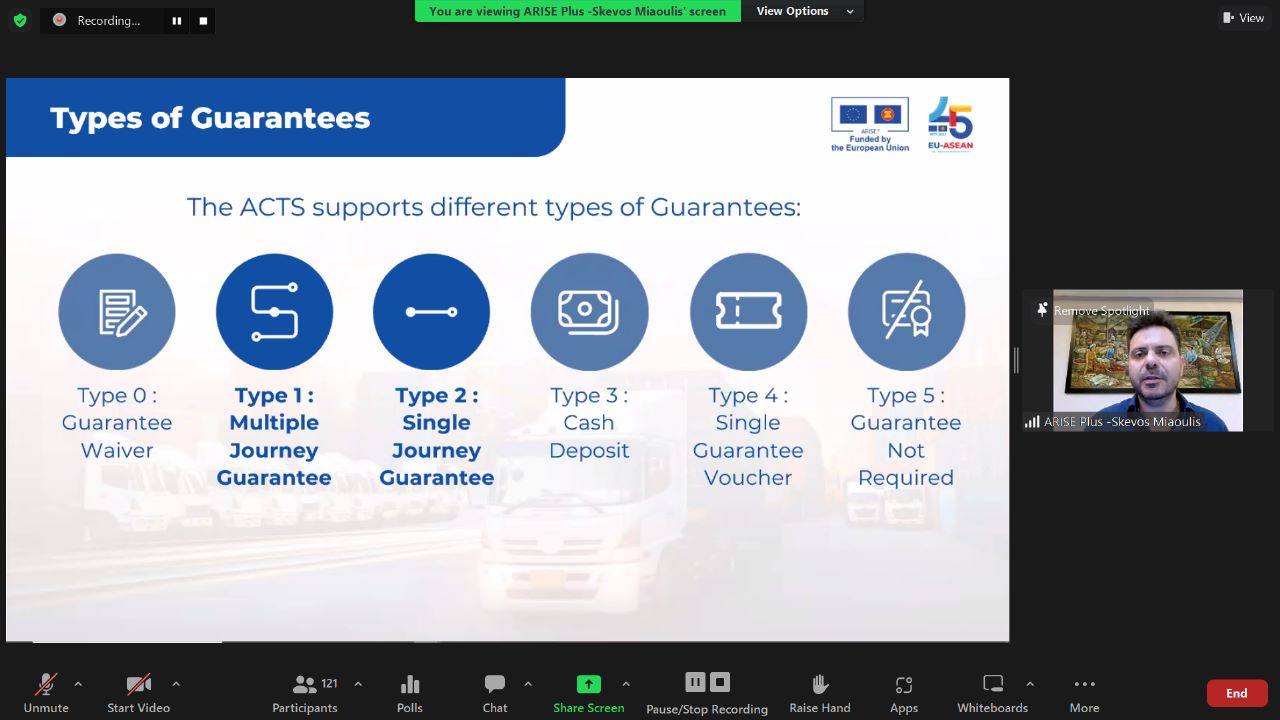

The keynote speeches were followed by presentations by the technical experts of ARISE Plus which were specially catered to the interest and role of banks in supporting ACTS. Three presentations titled: “Introduction to ACTS: A Bank’s Perspective”; “How Bank Guarantees Are Applied in ACTS”; and “Trade Facilitation Role of ASEAN Banks in the context of ACTS” provided the necessary information to encourage banks to extend the support required by the private sector.

The outreach event also served as a good platform to exchange views and clear doubts. The Q&A session was useful to address questions associated to the possible risk related to bank guarantees, guarantee claims and the implications of different types of currency used across ASEAN. The ACTS Outreach Event to Banks proved to be a useful event to engage, inform and discuss with the ASEAN banks. ARISE Plus is hopeful that the outreach event will stimulate better cooperation between the private sector and banks in taking advantage of the latest tool that supports more efficient movement of goods in the region that offers various benefits.